Diversification to Reduce Risk (in Dollars as of 12/31/2025)

Allocation Limits

To reduce risk, we limit portfolio investments to 7% per Company, 15% per Industry, and 30% per Sector. Our portfolio currently holds 39 stocks. Investors should have at least 10 stocks to achieve a basic level of diversification. It has been said that diversification is the only free lunch in investing.

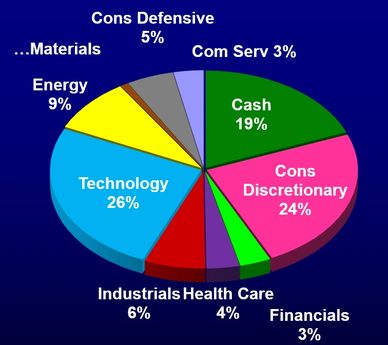

Sectors

Spreading your investments across different sectors helps to reduce risk. We currently avoid Utilities and Real Estate because we see better opportunities elsewhere. Nineteen percent of our portfolio is now in cash, and we are seeking the right stock and optimal entry point.

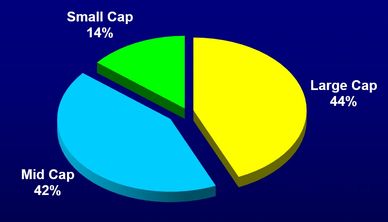

Class

Having a good mixture of asset classes also helps to reduce risk. 42% of our portfolio is comprised of Mid-Caps (stocks with a market capitalization of $2B to $10B). Midcaps are preferred because they generally carry less risk than Small Caps and can grow more quickly than Large Caps.

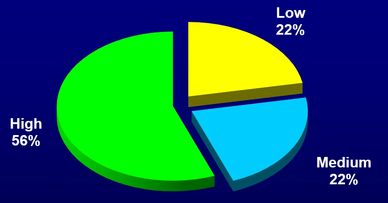

Beta

A stock with a beta greater than one historically moves more than the overall market. This chart shows one-year betas as Low (<1), Medium (1 to 1.19), and High (>1.2). 59% of our portfolio is currently invested in carefully selected higher-beta stocks, with betas ranging from 1.2 to 2.0, as we aim to outperform the market.

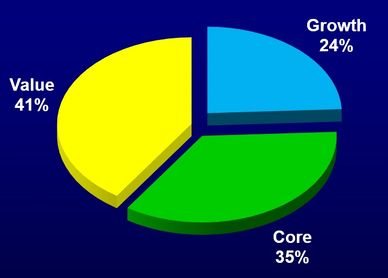

Style

The battle continues year after year, with growth stocks outperforming in some years and value stocks outperforming in others. Core stocks have a mixture of value and growth. We prefer to have some of each style and adjust it as market conditions dictate. This is my portfolio as defined by Morningstar.

Other Asset Allocation

Other assets such as Real Estate, Precious Metals, Bonds, Mutual Funds, and ETFs may also be appropriate, but this website is dedicated only to the individual stock portion of investments.

This Website and the Conclusive Stocks Emails are for educational purposes only. Nothing herein should be construed as an offer or the solicitation of an offer to buy or sell any security. Information contained herein was derived from sources believed to be reliable. However, no guarantees can be made concerning the completeness or accuracy of said information. Conclusive Stocks, LLC is not a Financial Advisor. Readers should make their own investment decisions based on what is appropriate for them after doing their own due diligence.